Taking payment after or prior to service

Within hospitality we often will take payments from customers at some point before or after service is given. This article explains how Kobas equips you to handle these situations.

Who can use this feature:

🥇Accounts on the Starters, Mains or All You Can Eat plan.

🔐Users with access to Reservations/Administration permissions.

Jump to:

- Introduction

- Deposits (pre-payments)

- Tab Credit (post-payments)

- Exporting to Xero

- Post-sale adjustments

Introduction

Most services or goods will be paid for at the time of receipt, or very shortly before or after. Examples include paying at the bar or counter for food/drink, or paying at the end of a meal in a restaurant.

Within the hospitality industry however, it is also commonplace to accept or take payments for services or goods before the event, or some time after:

| Kobas Terminology | Example scenarios | |

| Pre-payment |

Deposit Pre-payment |

Taking deposits for future reservations. This could be an arbitrary amount to secure a reservation, or could take the form of receiving payment in full for a future service. |

| Post-payment | Tab Credit |

Services or goods received are added to a bill, or a tab, to be paid at some point after the time. This could include paying at the end of an overnight stay in a hotel for food and drink from throughout the stay. Another would might be a company making payment for their work night out, within 28 days of the event taking place via Invoice. |

It is important that those involved in both Operational Management, and financial reconciliation of the business understand how these scenarios are processed within Kobas.

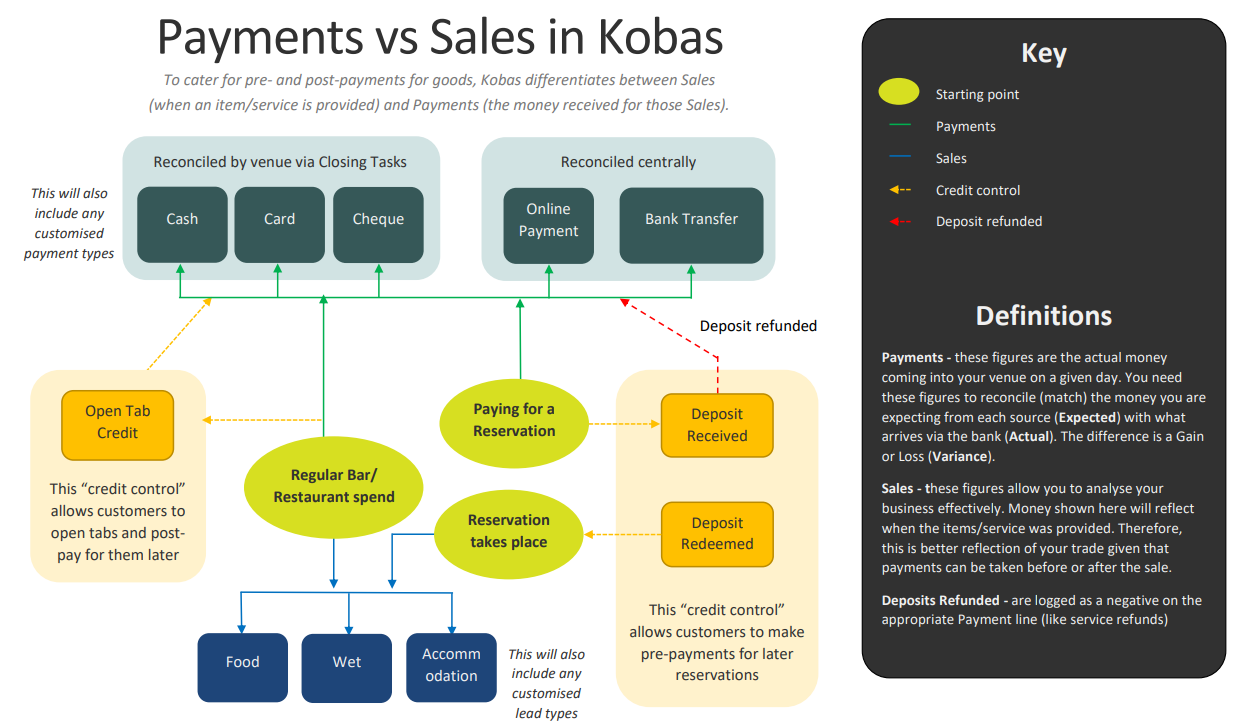

Because of the the ability to take payments at a different time to when the sales occurs, Kobas distinguishes between:

- Sales: These figures allow you to analyse your business effectively. Money shown here will reflect when the items/service was provided. This is a good reflection of your trade given that payments can be taken before or after the sale.

- Payments: The actual money coming into your venue. You need these figures to reconcile (match) the money you are expecting from each source (Expected) with what arrives via the bank (Actual). The difference is a Gain or Loss (Variance).

Please take a look at this guide, for a further visual representation of the relationship between Sales and Payments within Kobas:

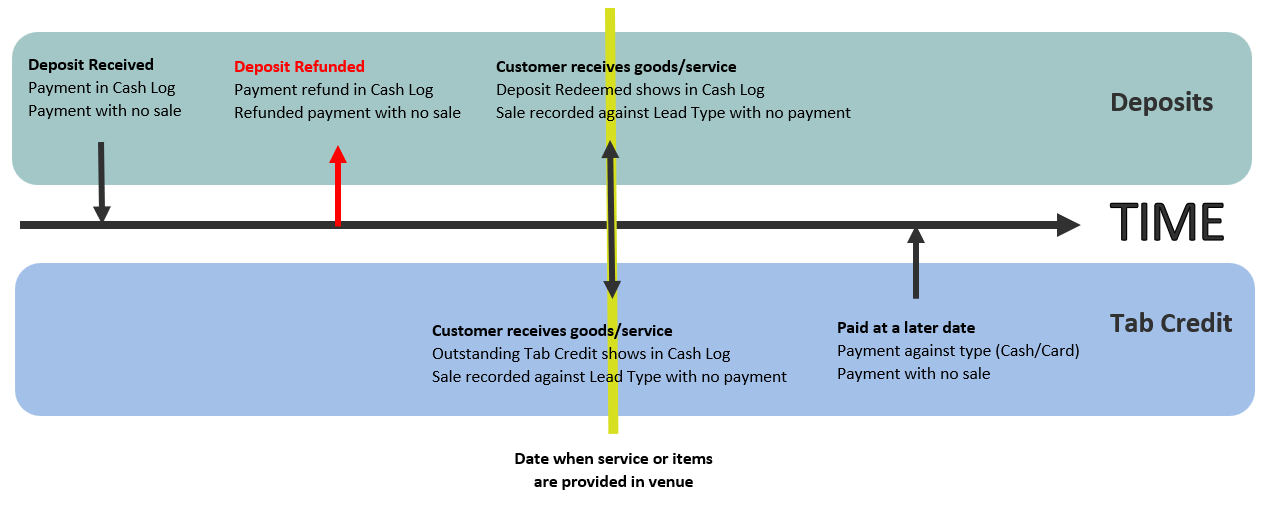

This diagram shows the above information on an linear time line:

Deposits (pre-payments)

Kobas offers two routes for the processing of Deposits, to cater for different client needs.

Reservation system

The Kobas Reservation system allows you to log deposits received against a customer and an upcoming event. Deposits can be taken in your venue(s) through EPoS, or other methods logged in Cloud such as Bank Transfer. These deposits can then be redeemed against EPoS sales for the event. This system allows full traceability of deposits held and reduces financial loss and customer dissatisfaction from paper records or human error. This system can be integrated with Inn Style (for room bookings) and Design my Night (for table bookings).

Ad-hoc Deposit Redemption

For clients who manage their deposits received and held entirely outside of Kobas, we do have the option to simply redeem deposits that aren't held against a particular reservation. This system has less safeguards and transparency inherent with it, but does allow flexibility should you use a third-party deposit system.

Reporting

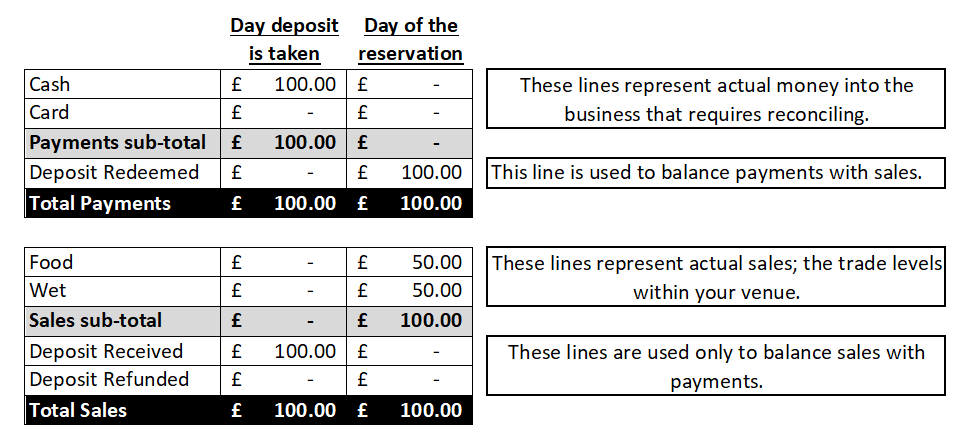

You will see these lines in financial reporting within Kobas that relate to deposits:

- Deposit Received: These figures represent money coming in, but for sales that will take place in the future.

- Deposit Refunded: These figures represent money going out, where you are returning a deposit.

- Deposit Redeemed: These figures represent when the money already taken (above) is used against sales, ie. the day of the reservation.

Top Tip: For more information on retaining part of a deposit before refunding, or when there is unused deposits, please read here.

This is an example of what some elements of your financial reporting would look like. In this scenario:

- The first day is the day where the deposit is paid for the event in £100 by cash.

- The second day is the day where the event took place, with £50 worth of food and £50 drink provided, paid in full by the deposit.

Tab Credit (post-payments)

The feature within Kobas EPoS that allows you to keep track of a customers spend before they pay is called Tabs. The basic functions of tabs are covered within the EPoS Basic Training.

It is also important here to understand what constitutes a Kobas EPoS "Session". In short, a "Session" encompasses the trade between two Z-Reads. Most of our clients will use one "Session" per trading day. When you Close Session (ie. Z-Read), the running totals are reset in your EPoS and you are expected to reconcile your takings for that day/session.

Tabs that are "settled" (ie. have all of their outstanding balance paid, and are closed) within the same session as they were opened, are not deemed to be a "post-payment". These tabs would, for all intents and purposes, be seen as being paid at the time of purchase.

Post-payment refers to Tabs that have been left open when you Close Session, and are Settled in a subsequent session.

In essence, you have extended "credit" to your customer in these instances, and as such we log the "credit" against the sales for that day, to account for the fact that the actual payments received are less than the sales.

Reporting

You will see the following lines used in financial reporting in Kobas relating to Tab Credit:

| Term | Definition |

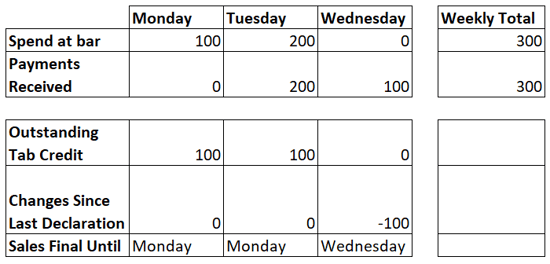

| Tab Outstanding Credit | A snapshot figure of the total value held on currently open tabs. |

| Tab Credit Change This Session | A running total of the changes in credit during these sessions. As tab credit increases, so will this figure. This figure will reduce as credit is paid off, therefore this figure can be negative. When all Tab Credit is settled, the total will be zero. |

| Sales Final Until | This is the last date where all tabs are closed and sales were finalised on that day. After this date, sales and payment figures maybe edited if open tabs are amended. |

Top Tip: Today's Outstanding Tab Credit will always = previous days Outstanding Tab Credit + today's Changes Since Last Declaration.

This example shows how some elements of your financial reporting would look:

- Monday - £100 is spent at the bar on drinks, but is put on a tab and left open

- Tuesday - £200 is spent and paid for at the bar on drinks, but the £100 tab from Monday is still open and outstanding.

- Wednesday - The £100 tab is paid off, but no further sales are recieved.

Exporting to Xero

Please read more about our integration with Xero here. It is the case that the Xero importer expects to see that for each day Payments = Sales. Therefore, we use a slightly different formula for Tab Credit for this export:

Declared Revenue (Till Z Total) - Deposits Received - Unused Deposits - Tips - Service Charge - Gross Sales + Refunded Deposits

Note: Therefore, the Xero export Tab Credit value is likely to be different to the Cash Log's Outstanding Tab Credit. These figures are calculated differently, for different reasons.

Other important notes include:

- All Kobas financial elements are mapped to a Xero nominal code, whether you use Deposits and Tab Credit or not.

- Deposits and Tab Credit within Xero need to be directed to a “control account”. This means the accounts will simply be the current liability of your current credit position. When all deposits are redeemed, and tab Credit settled, this account will have zero balance.

- For Tab Credit, there is one line to map over which will export negative and positive figures.

- Deposits have three lines which can be mapped to the same or separate nominal codes. When mapped to the same nominal code, they will counteract and zero out when all deposits have been used, similar to Tab Credit above. You could however have them go into separate nominal codes and check those accounts balance side by side.

Post-sale adjustments

Where tabs are still open between sessions, you have the ability as with any tab, to void EPoS Items already added to the tab, and to remove payments already recorded on this tab. These actions will then adjust sales figures in Revenue Reporting, as well as payment figures. This is why the Sales Final Until line is included.